One of my resolutions for the new year is to stop overspending and pay off debt by using the Debt Snowball Method. To manage my finance I’m using the Erin Condren Budget Book. I was using the Deluxe Monthly Planner but I like how structured the Budget Book is & that it’s compact. I can throw it in my Leather Folio when traveling or keep it in my On The Go Folio with all of my other Petite Planners. For more on how I save & budget there is a full blog post here.

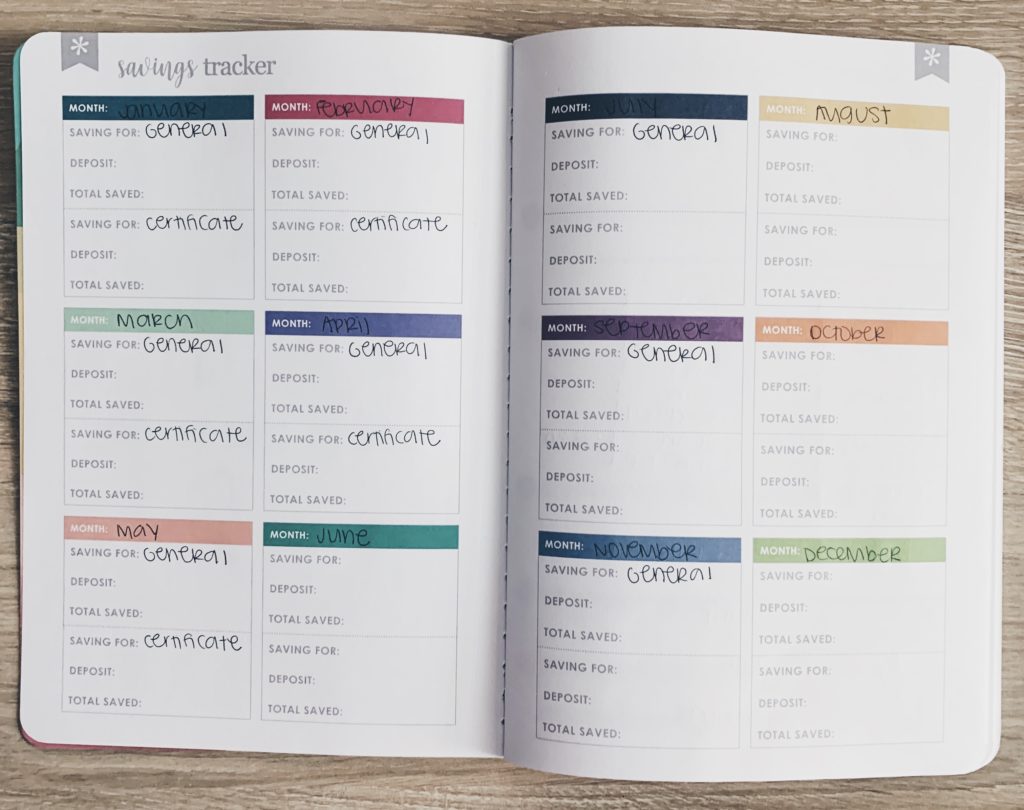

This is where I am going to track my monthly savings activity. This could be used to track if you’re saving for a trip or a big purchase. I will be tracking my main savings account & certificate of deposit. For more on how my account are set up click here.

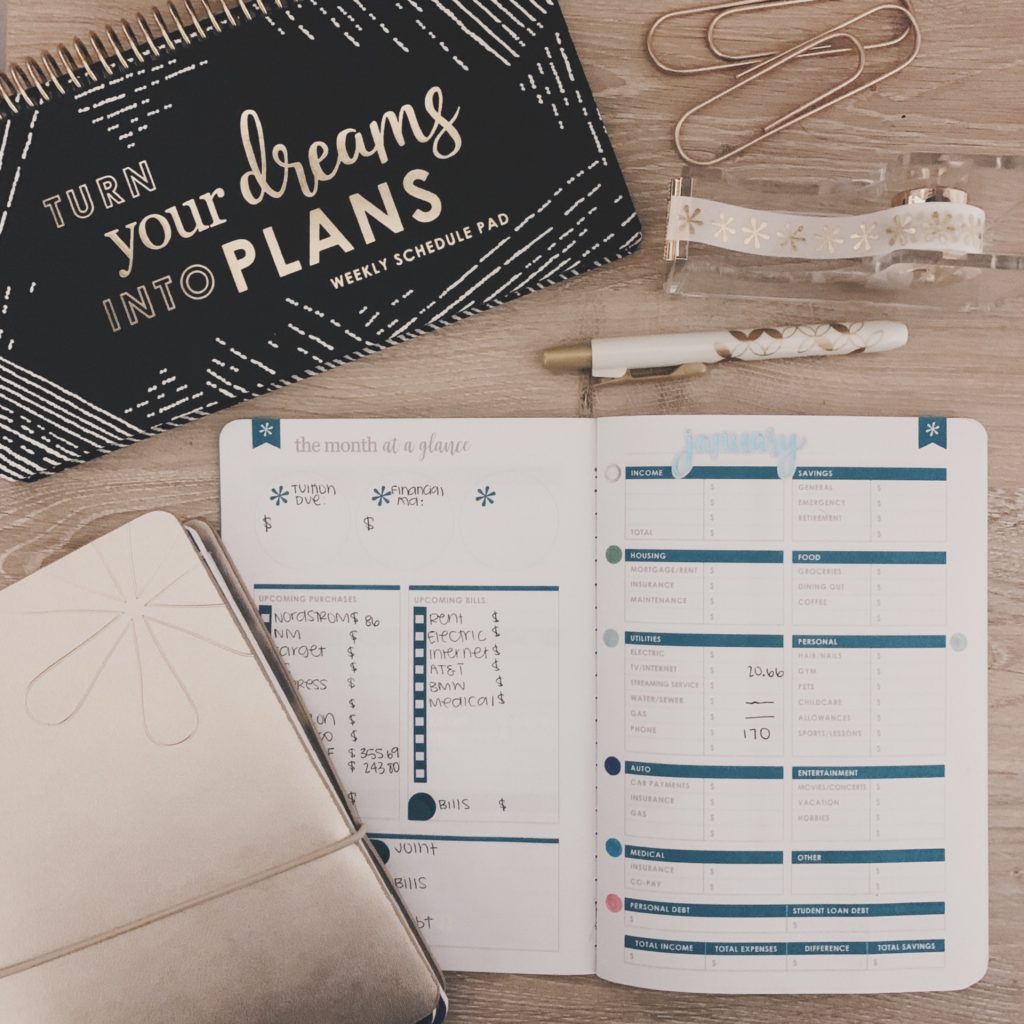

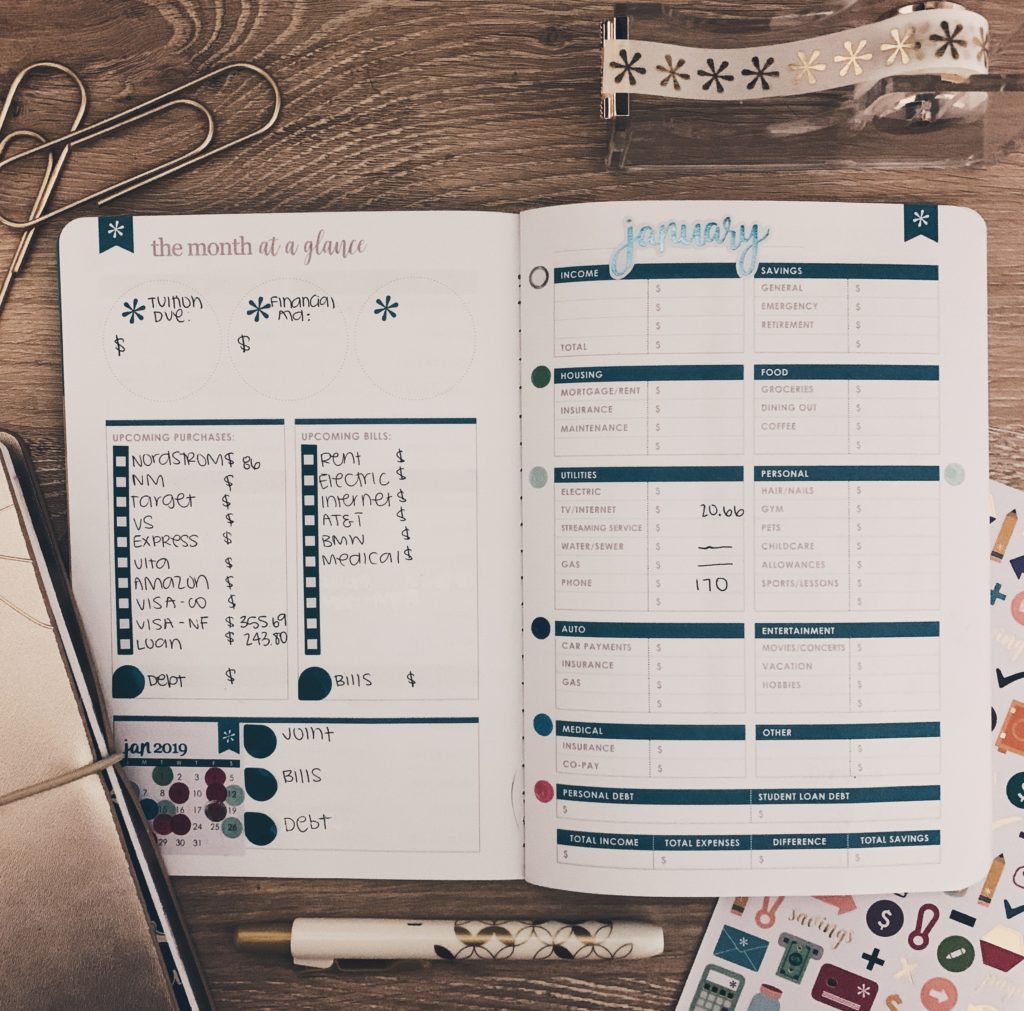

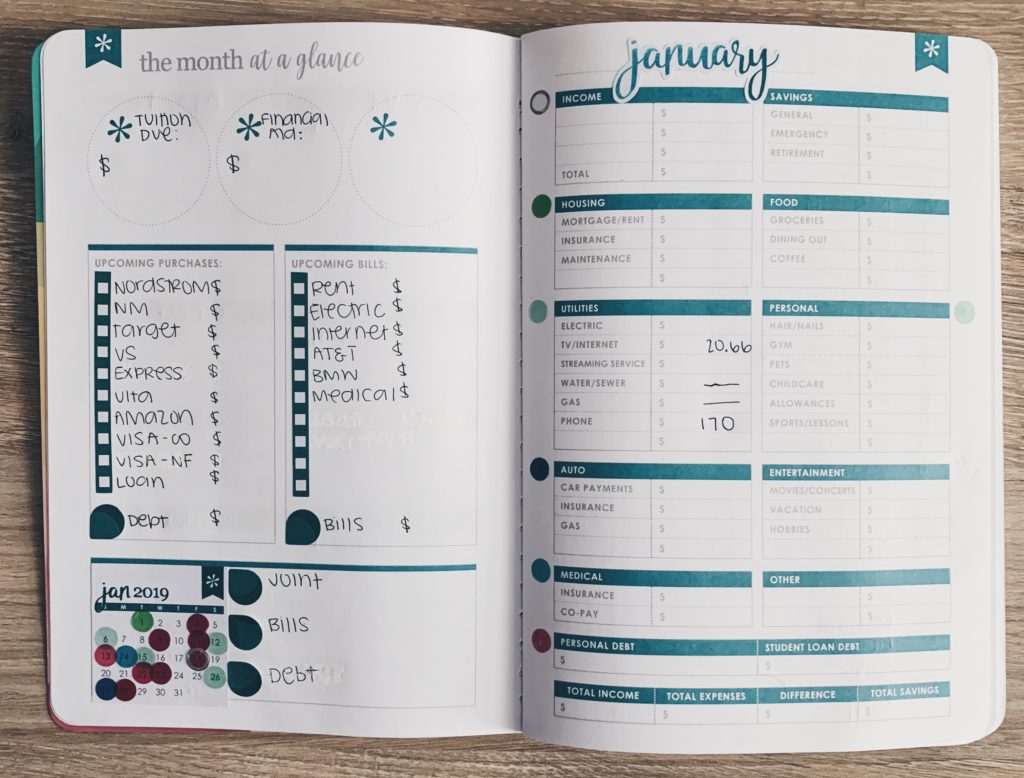

The Month at a Glance will hold all of my bills & banking information for the month.

Page 1

The top 3 will highlight important information for the month or unexpected bills like if I receive Financial Aid that month, when auto insurance is due because I pay every six months, if I am going on a trip, etc. Under “Upcoming Purchases” I am listing all of the amounts that are due (minimum payments only not including extra payments on this page) for credit cards or loans and major purchase amounts (like a trip, appliance, car maintenance, etc). Under “Upcoming Bills” is where all of my bills and utilities are listed (on the right side). I have a mixture of auto drafts & bills that I physically pay. So I put a “/” next to a bill when I transferred or deposited the money in my “Bills Checking Account” that everything comes out of. Then when a bill is taken out I will turn the “/” to a “X” in the box next to each bill. I colour coded bills with the Colorful Circle Sticker Pack. Everything under “Upcoming Purchase” is a pink/purple colour & “Upcoming Bills” is a green/blue colour. I inserted a small calendar from the 2019 Mini Calendar Sticker Pack for a quick reference on the bottom and marked due dates based on the colour code & next to it is the total amounts due for each account: Joint (Rent, Electric & Internet), Bills (Utilities, Auto & Medical), & Debt (everything under Upcoming Purchases).

Page 2

This is where I first write all of the amounts due and color code each category. Income and Savings are listed up top. Bills are under each category. Under Personal Debt & Student Loan Debt, I write the total amount due at the beginning of the month. All of my bills come in the month before so I always work a month ahead on the budget. So on the bottom line, I subtract the total income minus the total expenses for the difference. The difference amount is distributed for cash, groceries, personal (pedicures, movie tickets, etc), and for extra payments to pay down debt.

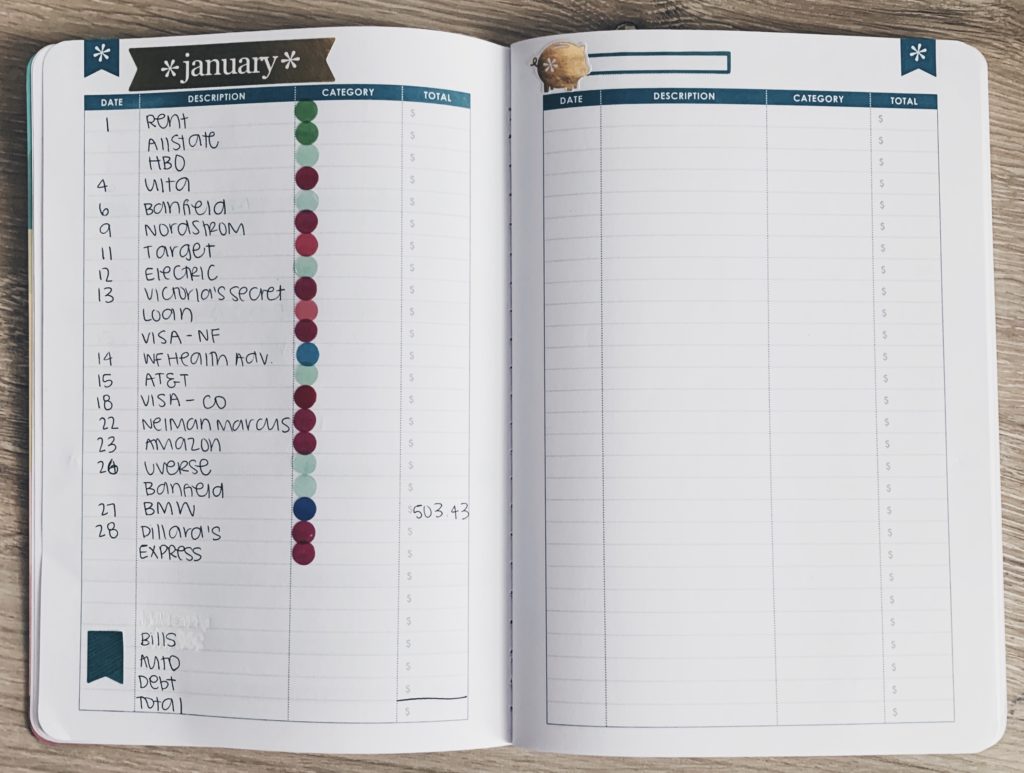

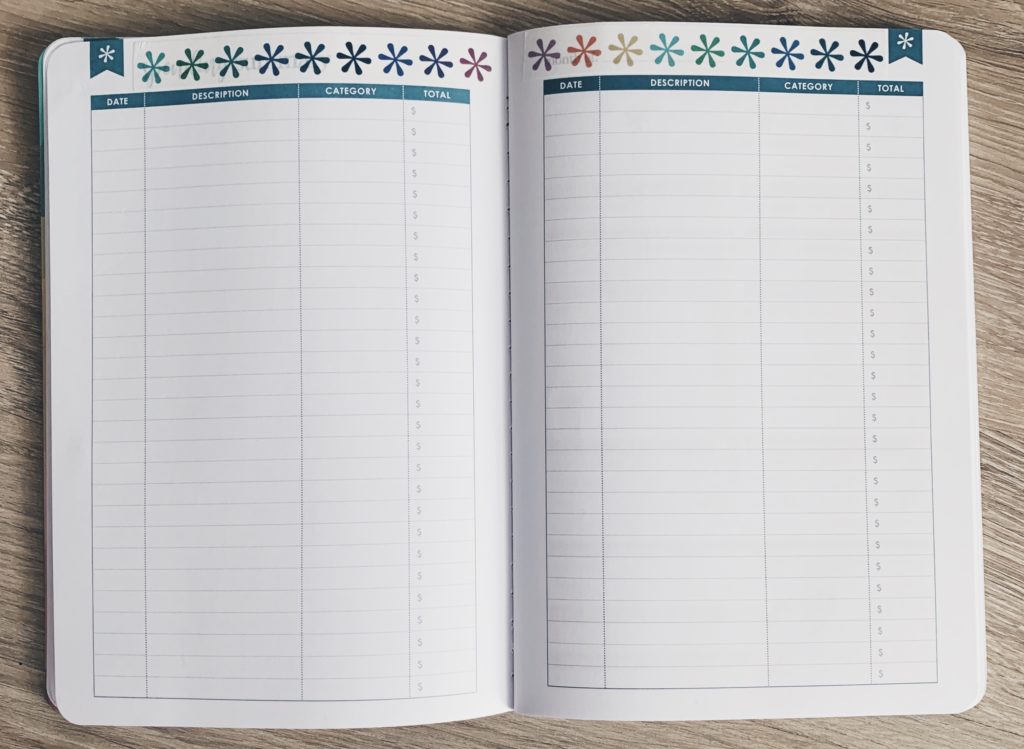

The Budget Book comes with 4 Spending Activity pages. I am using the first two (Page 3 & 4) as a Monthly Overview & Monthly Debt Tracker.

Page 3

This is my full list of bills by due date with it’s category colour. I list every account & bill with the due date even if there are accounts that do not have anything due. I go in and check every account each month to ensure that there is no unauthorized charges and that everything looks right. This is also keeps everything consistent in the Budget Book. On the bottom I add up all of the expenses by category and total amount due.

Page 4

This page is going to be the Debt Management Tracker for the month. This is where I will track minimum and extra payments on each account as I pay it. If I end up selling old clothes, receive a bonus at work, or something similar then I will make extra payments. The back of the book has a Debt Management Tracker and that is where I will put the total amount paid (minimum and extra) for the month with the new balance.

The last two Spending Activity pages (Page 4 & 5) will be used for Monthly Account Activity. Page 2 on the Monthly Overview has the difference between my total income and total expenses. The difference amount is what I use for cash, groceries, for personal (pedicures, movie tickets, etc), and for extra payments to pay down debt. This is where I track that activity and how I am spending my money.

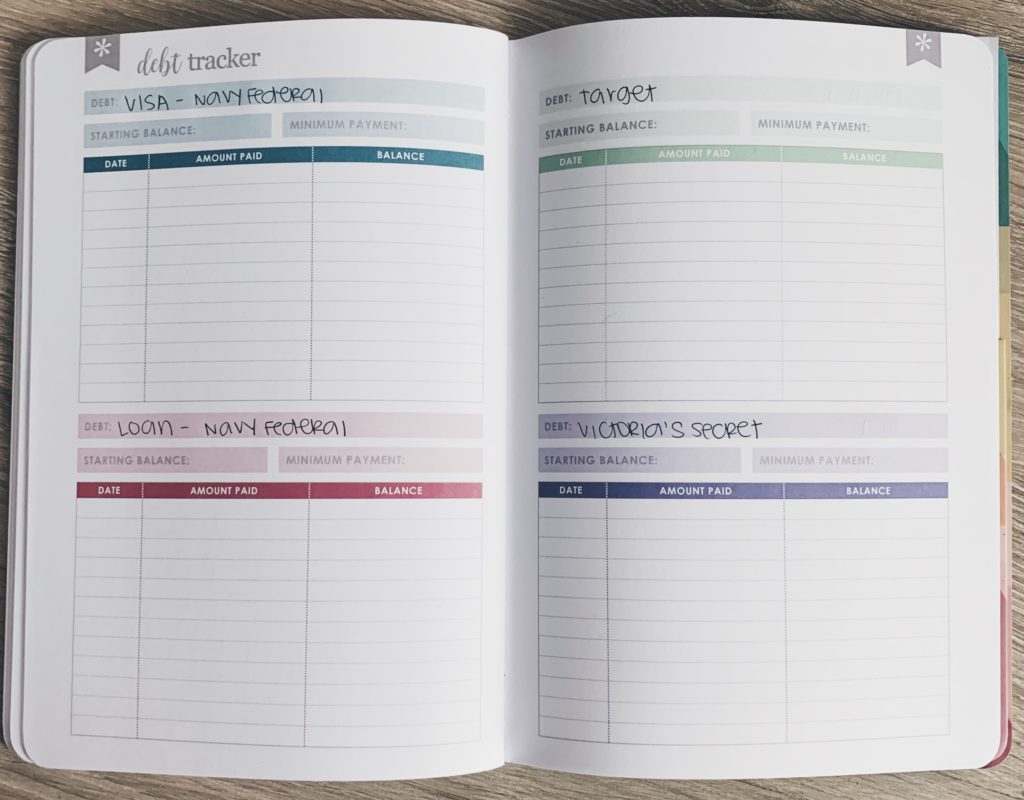

The Debt Tracker is going to be my year-at-a-view. This is where I will put the total amount I paid on each account and updated balance for the month (from the Monthly Debt Management Tracker/Page 4)

Erin Condren LifePlanner

I do like having a large monthly view so I am going to use Customizable Event Stickers on each Monthly View in my LifePlanner. Each sticker will have the same colour code that is in my Budget Book (images below of what I ordered). I liked the monthly overview when I used the Deluxe Monthly to budget & still wanted this view especially since the Customizable Event Stickers have icons now. This will give me a full view in my LifePlanner when I don’t have my Budget Book.