The 2019-2020 Erin Condren Deluxe Monthly Planner launches June 4th! Thank you to Erin Condren for sending me this planner so that I can set it up and share it before launch. I will be using my Deluxe Monthly Planner for budgeting and have finalized my set up for July 2019 to June 2020:

Set Up

Year View

I am using this calendar view for a quick glance and to mark dates for expenses and bills that do not occur monthly. Examples: car insurance, Amazon prime, blog expenses, etc.

New Goals

I’ve used this page as a savings tracker and event/major expenses tracker in the past. My focus in this planner is managing debt. So I will be using the New Goals page to track debt and expenses. The left side is where I will be tracking all of my debt: Tuition, Student Loan, Auto Loan, Health Expenses, Credit Card Debt, and Loan Debt. The right side is where I will keep expenses that do not occur monthly but need to keep track of: blogging, pets, car maintenance, etc.

Monthly Notes

I will be using the Monthly Notes page as a Monthly Overview. This page shows everything coming in, going out, and what I have for spending, saving & paying off debt.

Monthly Goals

My favourite addition to the new EC Deluxe Monthly Planner! I will be using these two pages to track events, expenses/transactions, financial goals, budget, & manage savings!

Monthly View

For this set up, I wanted to color code by category (housing, utilities, auto, etc.) and have amounts on the monthly view so that I can quickly go in and write down bills as they come in.

Monthly Pages

I incorporated past ideas from the 2017 Painted Petals and 2018 Woven Wonder Deluxe Monthly Planners that worked for me when budgeting. For the Bills page, I used the templated from the Erin Condren Budget Book and added flag stickers for my monthly food, personal, and entertainment budget. For the Bills Tracker page, I wanted to add more to this page then what I was currently doing. So I separated Monthly Expenses (Housing, Utilities, Medical, & Auto) & Monthly Debt (Credit Cards & Loans). For the Monthly Expenses, I am using this page to track due dates, the amount I’m paying, the account the amount is coming out of and when it’s paid. For the Debt section, I am tracking the due date, the minimum amount due, and the amount I’m paying (so that I can track if I’m paying extra). The credit cards and loans are sorted by due date to make it easier to pay bills.

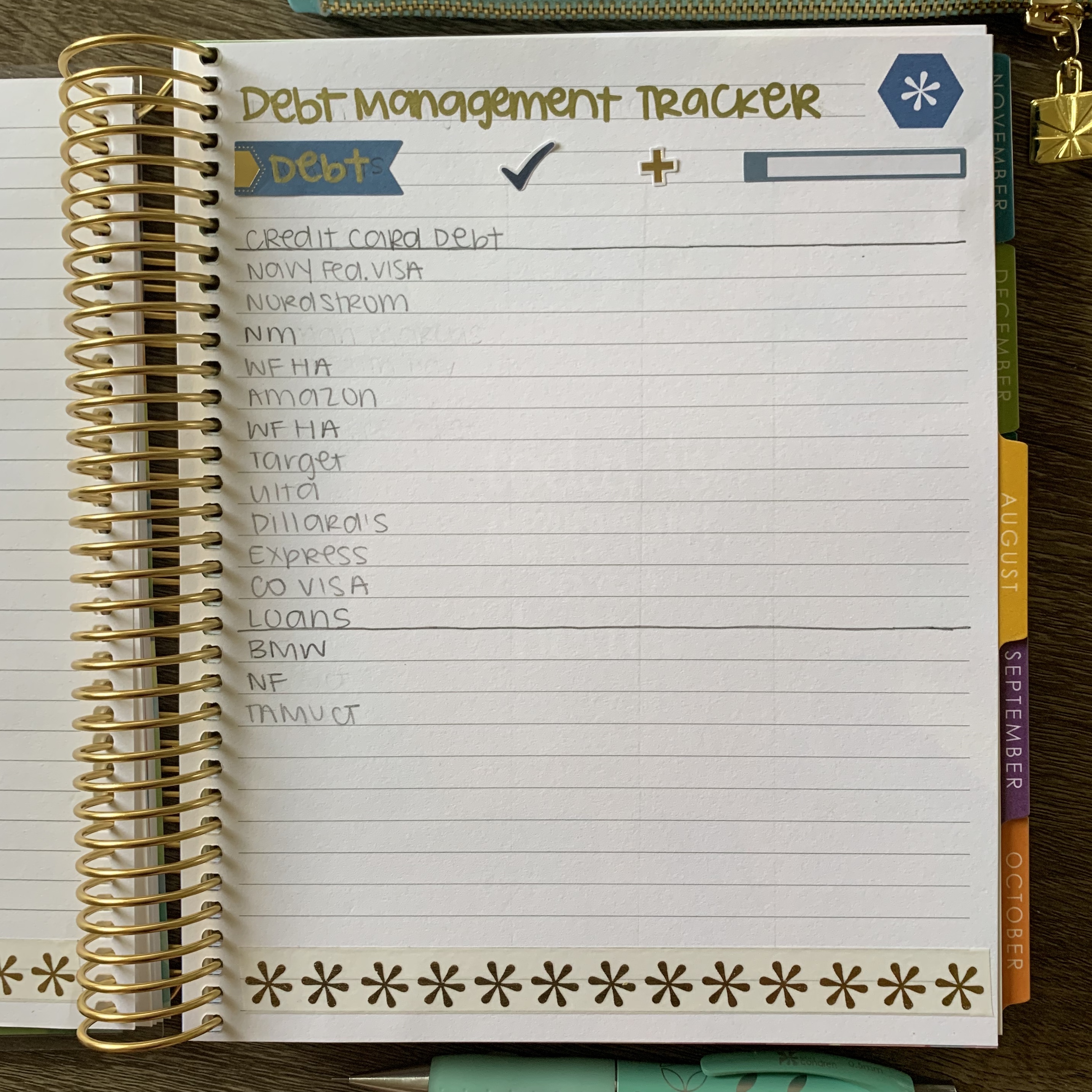

The Budget page is where I incorporated the structure from the 2017 Painted Petals EC Deluxe Monthly Planner. There we’re five boxes where you could track categories or, what I did, weeks in the month. I will be using this page to track my spending. The Debt Management Tracker is my favorite page. I separated my Credit Card Debt and Loans and sorted both by balance from highest to lowest. I am doing the Dave Ramsey Baby Steps & currently working on paying off debt with the Debt Snowball Method, so I will be working my way up the list when paying off debt. This helps me see what I can pay off monthly and the progress I’m making.

Notes

I use the notes for a lot: account information, log in information, loan information, savings tracker, debt tracker, financial aid allotment, and anything that has to do with!